Once you finish medical school, it’s time to embark on the next phase of your career: medical residency. This hands-on experience is a graduate-level step towards becoming a full medical professional with a license to practice.

The length of your residency depends on your specialization, and you can expect to earn a bit more each year. While some specializations earn less than others once you’re a fully licensed practitioner, in residency your salary only varies with what year of your post-graduate training you’re in.

Learn more about how much you can expect to earn for your medical resident salary, plus how to understand the true costs involved with relocating and other factors.

Residency Salaries by State

According to 2025 data from Panacea Financial’s Residents & Fellows Report, the average first year medical resident earns $65,557. But there are a number of factors that impact how much you’ll actually earn during your residency.

Start by understanding the average resident salary by state to get an idea of how geography affects earnings. This data from Zippia ranks each state by average annual salary.

State | Average Resident Annual Salary | Rank for Highest Pay |

Alabama | $52,331 | 42 |

Alaska | $55,237 | 29 |

Arizona | $55,511 | 27 |

Arkansas | $53,411 | 38 |

California | $53,562 | 36 |

Colorado | $55,731 | 25 |

Connecticut | $57,688 | 11 |

Delaware | $58,382 | 8 |

District of Columbia | $56,892 | 15 |

Florida | $54,392 | 33 |

Georgia | $57,132 | 13 |

Hawaii | $55,832 | 23 |

Idaho | $52,365 | 41 |

Illinois | $57,726 | 10 |

Indiana | $57,054 | 14 |

Iowa | $55,840 | 22 |

Kansas | $51,319 | 45 |

Kentucky | $54,977 | 30 |

Louisiana | $51,806 | 44 |

Maine | $65,889 | 1 |

Maryland | $56,638 | 16 |

Massachusetts | $61,991 | 2 |

Michigan | $55,974 | 21 |

Minnesota | $55,500 | 28 |

Mississippi | $47,570 | 49 |

Missouri | $52,763 | 40 |

Montana | $50,434 | 47 |

Nebraska | $52,798 | 39 |

Nevada | $59,599 | 5 |

New Hampshire | $54,398 | 32 |

New Jersey | $60,577 | 4 |

New Mexico | $46,323 | 50 |

New York | $61,242 | 3 |

North Carolina | $56,233 | 19 (tie) |

North Dakota | $49,242 | 48 |

Ohio | $58,313 | 9 |

Oklahoma | $52,236 | 43 |

Oregon | $55,778 | 24 |

Pennsylvania | $56,549 | 17 |

Rhode Island | $58,675 | 7 |

South Carolina | $57,234 | 12 |

South Dakota | $56,223 | 19 (tie) |

Tennessee | $53,458 | 37 |

Texas | $51,261 | 46 |

Utah | $58,817 | 6 |

Vermont | $54,361 | 34 |

Virginia | $56,360 | 18 |

Washington | $55,652 | 26 |

West Virginia | $54,212 | 35 |

Wisconsin | $54,430 | 31 |

Wyoming | $56,008 | 20 |

See Also: Practical Financial Planning Tips For Residents & Fellows

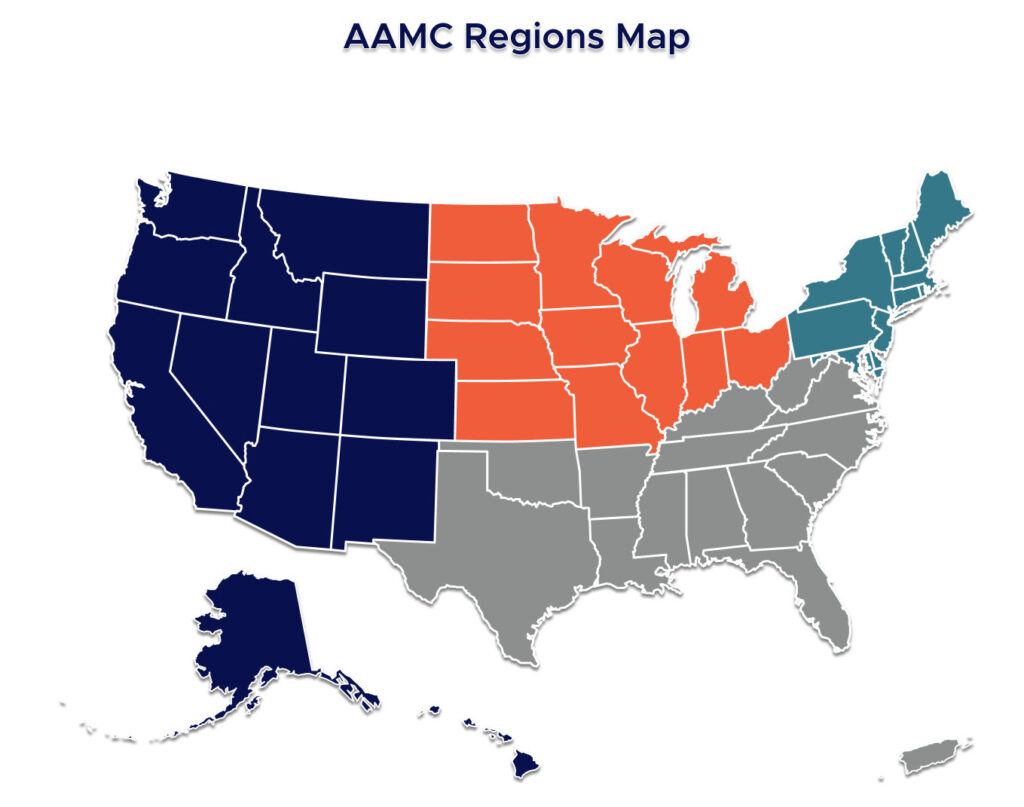

Residency Salaries by Region

Residency salaries not only vary by region, but by how far along in the program you are. Here is an overview of the regional mean stipends by year, according to the 2024 AAMC Survey of Resident/Fellow Stipends.

Northeast Region

- Year 1: $70,773

- Year 4: $82,463

- Year 8: $95,097

South Region

- Year 1: $62,198

- Year 4: $69,233

- Year 8: $84,205

Central Region

- Year 1: $64,572

- Year 4: $71,604

- Year 8: $86,664

West Region

- Year 1: $71,622

- Year 4: $82,538

- Year 8: $99,596

How Medical Residency Salaries Are Determined

Medicare covers Direct Graduate Medical Education (DGME) to pay resident salaries, as well as teaching stipends and building maintenance. Each hospital decides how to portion the funds between medical resident salaries and those other eligible expenses.

These salaries don’t match cost-of-living adjustments in many areas of the country, especially in areas with real estate markets that are disproportionately high. When researching residency programs, it’s important to consider the full scope of benefits package compared to realistic living expenses.

Some hospitals may offer an average resident salary compared to national levels, but are actually located in above average housing markets. Consider the costs involved and some drawbacks you may encounter, like living with a roommate or farther away that requires a longer commute.

Some larger healthcare organizations offer competitive residency programs with supplemental compensation networks in addition to a base salary. Kaiser Permanente’s Southern California residency program, for instance, provides benefits such as a housing stipend and meal allowance.

Of course, health systems with larger budgets are able to offer better incentives to attract talent. The bottom line is that you need to create a sound budget based on each area you’re considering for your residency. Don’t assume the largest benefits package automatically gives you the most financial security.

See Also: What Happens Between Match Day and Residency? We’ve Got Your To-Do List

Is Residency Pay Enough?

Hospitals typically receive more than $100,000 in federal funding for each medical resident, but must use some of the funds for other costs.

Research reveals growing dissatisfaction among medical residents about the amount they earn, particularly compared to the hours they put in. For instance, a resident who works 80 hours in a week could end up earning less than $15 an hour. Panacea Financial’s 2025 Residents & Fellows Survey Report revealed that trainees rated their compensation satisfaction at an average of 5.1 out of 10 (where 1 was very unsatisfied and 10 was very satisfied).

And low salaries can put medical residents on precarious financial footing. The average trainee has almost $300,000 in student loans — and that can often go much higher. Many residents may opt to enter into a forbearance period to avoid making payments on their student loans. While this option provides temporary relief, interest continues to accrue, causing the loan balance to go even higher than when you finished your degree program.

Plus, 26% of physicians carry credit card debt, revealing that living expenses can also be hard to keep up with. All of these financial pressure points explain why over 90% of medical residents respond that future earnings directly influence their choice of specialization.

See Also: 10 Tips for New Residents

Key Takeaways for Medical Residents

In most cases, your medical resident salary will not play a major part in your decision on where to train. But you can make sure you know the financial implications of the decisions you are making as you choose which residency programs to apply for.

Consider the whole benefits package, along with what type of living expenses you can expect in each geographic area, and practice setting up a budget.