BUSINESS

Checking & Savings Accounts

Loans for medical, dental and veterinary practices, business checking and savings accounts for all businesses! Take advantage of free business checking and savings accounts online without the hassle.

Banking Made Easy

Savings

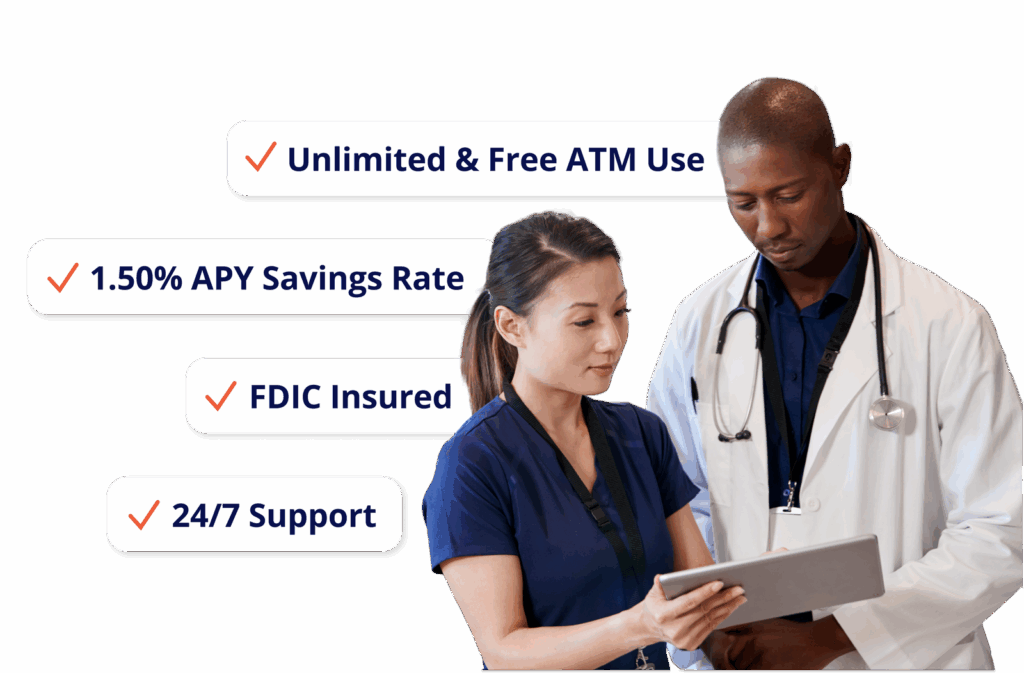

Our Panacea Business Savings Account offers an excellent rate at 150x Bank of America’s Business Savings3 – 1.50% APY2.

Checking

Our Panacea Business Checking Account is designed with you in mind with free ATM use nationwide, no overdraft fees, and a custom debit card.

Best of all, our mobile app and online banking provide maximum flexibility and convenience. If you want to speak with us, we’re always available 24 hours a day, 7 days a week.

100% Free Business Checking

- 0.10% APY on balances > $100,000

- FREE ATM use nationwide1

- FREE incoming & outgoing wires

- FREE custom checks

- FREE custom debit card

- FREE cashier’s checks & stop payments

- NO fees

Business Savings

Available to all businesses owned by doctors and non-doctors alike!

- 1.50% APY2 – 150x Bank of America’s Business Savings APY3

- Open an account with as little as $25

- Fund your account for free!1

- FDIC insured4

Additional Services

- Remote deposit – Funds available next day

- ACH services – Schedule recurring or one-time payments

- Fraud protection

- Wire services – Unlimited incoming and outgoing domestic transactions

FAQs

Who is eligible for a business checking and savings account?

Our totally free business checking and savings accounts are available to all businesses! We want to share this product with businesses in every industry!