Financial literacy is a crucial skill for all doctors, but it can be challenging to stay on top of your finances when you’re busy with your career. As a doctor myself who co-founded the national digital bank for doctors, I see trends in financial challenges that Panacea customers and my colleagues often face.

Let’s take a look at five common financial pitfalls for doctors and how to avoid them. By understanding these pitfalls, doctors can make better financial decisions to reduce financial stress.

#1: Remaining Financially Untrained

Financial Literacy In The U.S.

The state of financial literacy in the U.S. is pretty bad. Here are some startling facts:

- The United States ranks 14th in the world in terms of financial literacy with 57% of adults being financially literate. This ranks the U.S. below countries like Canada, Germany and Denmark.

- Less than 20% of U.S. students are required to take a personal finance class while in school.

- 76% of millennials lack basic financial knowledge.

Doctors’ Financial Literacy

We see a similar lack of financial education in physicians, dentists and veterinarians in a few key, unique ways. Our professions delay earning through our extended education and training, then once we begin practicing, we go from making nothing or very little to a more significant salary. In a lot of cases, we are not adequately prepared for that transition.

While we looked at Americans as a whole earlier, there is data out there that specifically looks at doctors. One study, “An assessment of residents’ and fellows’ personal finance literacy: an unmet medical education need,” found that residents and fellows had low financial literacy and investment-risk tolerance, high debt, and deficits in financial preparedness.

Doctors typically have high debt, especially in training and early in their careers. That doesn’t mean this debt was a bad choice. Most doctors have to incur hundreds of thousands of dollars of debt, and for many, it’s unavoidable. Despite this, it is important to understand the implications this debt can have on the rest of your life.

Doctors’ Attitudes Toward Finances

There are two primary attitudes I see doctors have about finances:

- Ignore their finances. Some doctors choose to ignore their finances because they are so busy with work and know they make enough money to get by. They choose to put it out of sight, out of mind and deal with it later.

- Become a self-taught expert. Other doctors will equate their intelligence to being able to become an expert on finances. Some may achieve that, but others may overinflate their expertise without the time or training put into it.

Many of us are in the middle, but you may know colleagues that fit in either of these extremes.

Resources For Financial Literacy

No matter where you are on the spectrum between these attitudes, you may be searching for additional financial education. Here are some resources I recommend:

- Books

- Living Rich by Spending Smart by Gregory Karp – For budgeting help and how your finances interact with your life in the big picture.

- Personal Finance for Dummies by Eric Tyson – For basic personal finance principles everyone should know.

- The Only Investment Guide You’ll Ever Need by Andrew Tobias – For knowing what to do with your money once you save up and are ready to invest.

- The Bogleheads’ Guide to Investing by Mel Lindauer, Michael LeBoeuf, and Taylor Larimor – For the more financially literate doctor ready to learn about investing.

- Other resources

- Physicians on FIRE website and Facebook forum – Information and discussion about achieving financial independence and retiring early.

- Prudent Plastic Surgeon – A current plastic surgeon who is working alongside other doctors to achieve financial freedom.

- Bogleheads Wiki – Articles that can lead you on the personal finance journey you are aiming for.

#2: Lifestyle Creep

Hedonic Treadmill

Before diving into lifestyle creep, let’s talk about the psychology of it with something called the Hedonic Treadmill. This research-based principle examines the psychology of why we seek out things that will make us happy and that we expect to lead to long-term happiness.

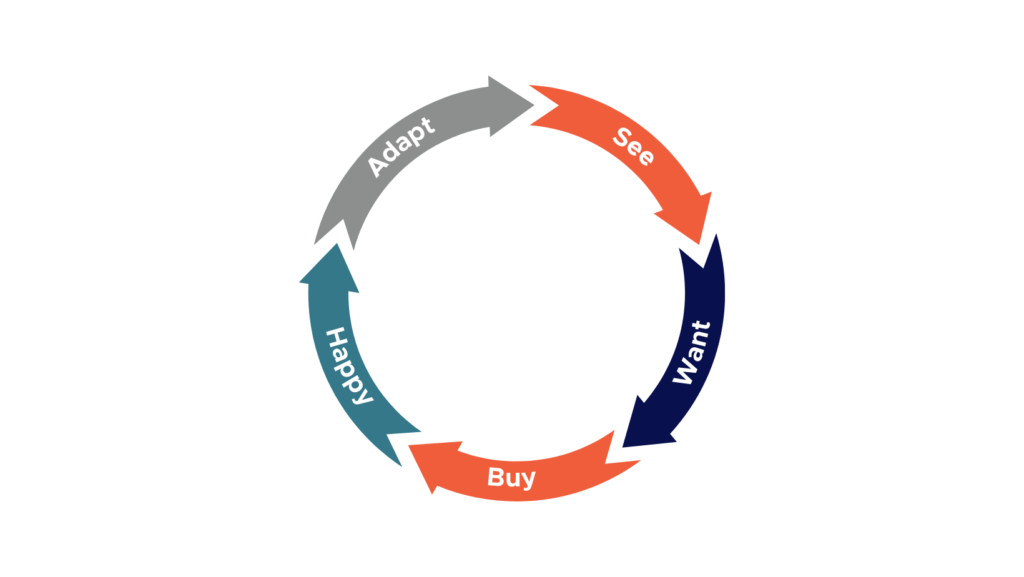

In this case, we are talking about buying things. Here’s how a doctor could experience this phenomenon:

- Buy: You finally get out of residency and decide to buy yourself a nice car. You deserve it after all of your hard work, right?

- Happiness: You are happy! A new car is exciting!

- Adapt: After a few days, weeks or months of owning your car, the thrill wears off. It’s not quite as exciting, and you return to a base level of happiness.

- See: Since your car isn’t as exciting anymore, you start seeing new cars that are nicer than yours.

- Want: You want the newer car.

This cycle continues. After wanting the newer car, you eventually decide to buy it. The excitement of the new car fades until you buy the next one. It just continues, not leading to sustained happiness. Instead, it impacts your finances.

As doctors, we stay in the want phase for a long time, as we deal with low or no income during school and training. Once we finally get that signing bonus or first paycheck, we are ready to purchase everything we’ve been waiting to buy, but those things don’t actually result in happiness.

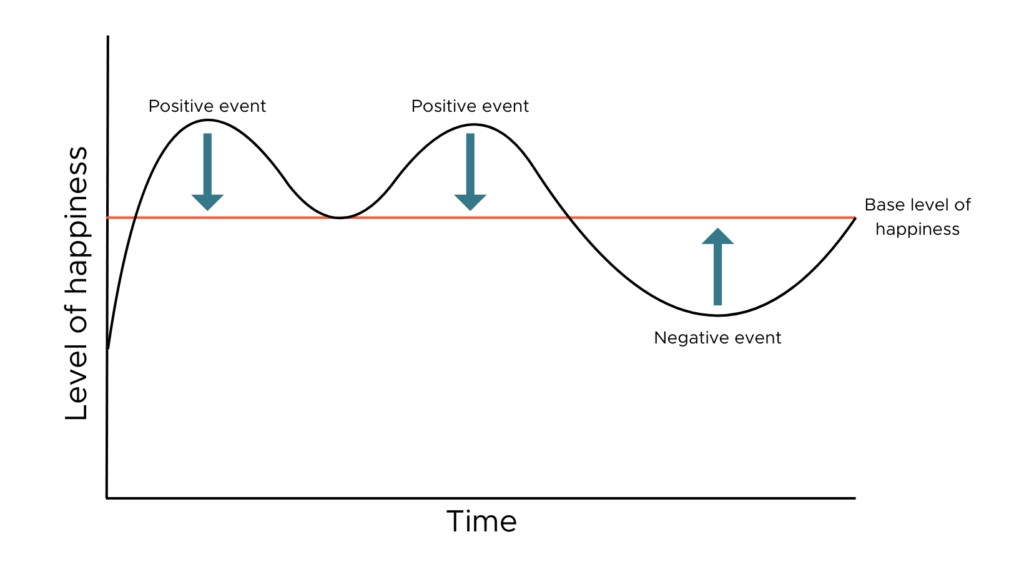

Happiness Set Point

This plays a part in the psychological principle of the happiness set point. This means each person has a baseline level of happiness. You have positive events (like buying a car, getting your first paycheck, etc.) and negative events, but eventually you return to that set point, meaning these events don’t typically lead to sustained happiness.

This happiness set point can help you recognize that buying the best or most expensive thing likely will not give you the sustained happiness you are searching for, and it could actually be more detrimental as it leads to financial challenges down the road.

Spend On What Matters To You

This does not mean you shouldn’t buy anything or you should stick to only the most basic needs. It just means you should be conscious of your spending. Here are three things to consider as you determine what purchases you want to make:

- Wants are personal, and they vary from person to person.

- Consider experiences rather than possessions. Money spent on experiences can lead to more happiness than money spent on other things.

- A good mindset to have: “You can buy anything but not everything.”

Resources For Happiness & Wealth/Income

Here are two data-driven resources on happiness, including how income and wealth impact it:

- The Good Life by Marc Schulz and Robert J. Waldinger – A Harvard adult development survey that began in the 1930s, the longest longitudinal research study on humans. “Good relationships don’t only protect our bodies, they protect our brains.”

- The Happiness Lab with Dr. Laurie Santos – A Yale podcast that examines data-driven behavioral science.

#3: Poor Planning

Before you make leaps into significant investments or cryptocurrency, you need to make sure you’re saving a lot.

Here are basic savings suggestions:

- Save at least 20% of your salary. (This is more than the average American, but it is encouraged because of the delay in earning.)

- Build an emergency fund (3-6 months of expenses). Placing it in a high-yield savings account or money market account will allow it to grow passively through interest.

- Set a budget and stick to it.

Big Picture Planning

Once you have the basics down, it’s time to think about big picture planning. We can break that down into three parts:

- Protect: This is the most important piece. It includes: insurance, asset protection and legal documents.

- Plan: Cash flow planning, debt reduction, investment strategy, tax strategy and estate planning

- Play: Travel, luxury items and vacation property

Some people end up mixing up these priorities, valuing “play” over “protect,” but it is very important to ensure you are protected before you dive into the fun stuff. Prioritizing “play” can mean you have no budget, no plan for debt management, no tax strategies, wills are not updated, no advisory team, and poor contract negotiations, or some combination of these. This can lead to challenges down the road.

Another facet of planning is ensuring that you have good credit and your credit score is high. We breakdown more about improving and maintaining your credit score here.

#4: Following Bad Advice

We are doctors. That means we typically have a lot of money, and everyone’s trying to get some of it, which can lead to bad advice and bad decisions. Here are some tips as you navigate your finances:

Be skeptical. Here’s some advice from William Bernstein, a financial theorist, “If you act on the assumption that every broker, insurance salesman, mutual fund salesperson, and financial advisor you encounter is a hardened criminal, you will do just fine.” A healthy amount of skepticism is a good thing when it comes to personal finance.

Avoid bad advice. For most of us, choosing one-off stocks like GameStop, investing in DogeCoin, or day trading on Robinhood aren’t going to be the ticket to financial freedom. Here is some common bad advice that we think you should avoid:

- Pick stocks

- Chase the latest trends

- Pay high fees

- Time the market

- Hire salespeople to manage your investments

- Follow advice from the doctors’ lounge

Find a trusted advisor. Instead of following that advice, we encourage you to find a trusted advisor. A fiduciary is preferable, meaning someone who is required by law to manage a person’s money and property for the person’s benefit, not their own. This could be a CFA or CFP.

Find someone with doctor experience. Using a financial advisor with experience working with doctors can be extremely beneficial. They will have a better understanding of your career path, your financial life cycle, and other doctor-specific factors. Don’t be afraid to ask for a reference from a doctor they have worked with.

Get connected to a healthcare-specific financial expert for free with Build Your Team.

#5: Having No Student Loan Repayment Strategy

Many doctors graduate with no concept of what to do with their student loans. First, you should know whether you have federal or private student loans (or both). If you have federal student loans, there are three main ways to address your student loans:

- Forgiveness: Pay the least over time and get the rest forgiven through programs like Public Service Loan Forgiveness or Income-Driven Repayment plans.

- Repay: Pay your loans off in the shortest amount of time with minimized interest accrual but high monthly payments.

- Refinance: Allows you to choose your repayment length, and it may lower your interest rate. Only do this if you are absolutely sure because you will lose access to PSLF and IDR.

For private loans, the options are:

Resources For Student Loan Strategy

- Pros & Cons Of Refinancing Student Loans

- Guide To Repaying Private Or Refinanced Student Loans

- Public Service Loan Forgiveness For Doctors – Physicians, Dentists & Veterinarians

Avoiding These Financial Pitfalls

Now that you know these financial pitfalls, I encourage you to take a look at your own financial literacy, plans, budget and more to understand where you may struggle and what you should watch out for.

If you need help getting your finances in order, speak with a trusted, doctor-specific financial expert. You can get connected to one for free through our Build Your Team program.

For more financial resources that address doctors’ unique needs, check out our Resource Library.