Inflation is now at 7.1%, lower than the peak of 9.1% in June, but still higher than any point since the 1980s. Americans have been feeling the effects of this with more costly groceries, gas, rent and more.

The Federal Reserve is aggressively raising rates in an attempt to slow spending, cool the economy and reduce the worst inflation in four decades. The Fed hopes increased rates will bring inflation down to the desired 2 percent.

Despite the hope this brings for cheaper consumer costs in future, increasing rates mean financial products are more expensive right now. What do doctors need to know about how these rates will impact their financial needs?

Understanding the interest rate hikes

Rate increases and inflation have been a popular topic in the news and conversation recently, but how do these rate hikes really affect you?

Since the beginning of 2022, the Fed has raised rates seven times to a range of 4.5 to 4.75%, with their latest hike in February raising the rate by 25 basis points. Banks use the Fed rate as a guide to help determine the rate they charge for certain products such as mortgages, personal loans, or auto loans.

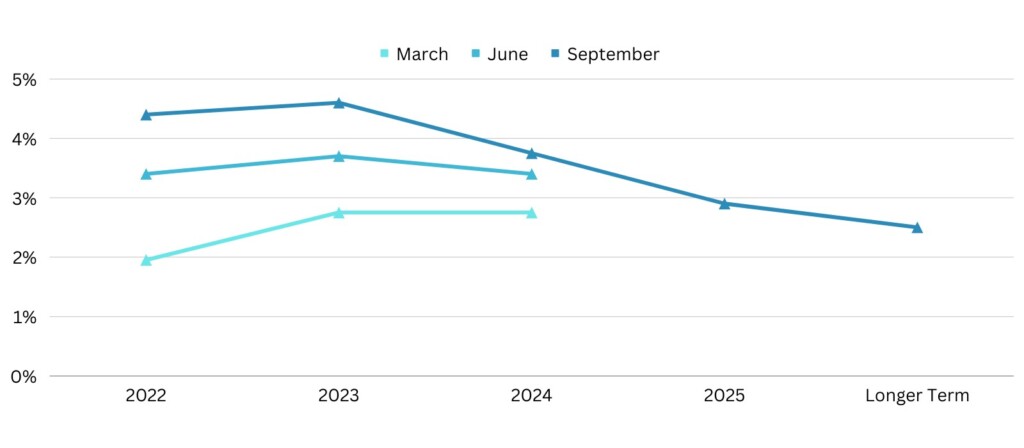

The policymakers forecasted continued interest rate increases by an additional 0.5% through 2023, which by design would make borrowing more expensive and should decrease the amount of money in circulation and lower inflation.

So let’s take a closer look on how rising interest rates can affect you in your daily life.

How do rising interest rates affect my credit card?

Credit card companies typically base rates on banks’ prime rates which move in tandem with the Fed, which means your borrowing costs are increasing.

The average credit card interest rate as of July 15, 2022 is 22.91%, the highest rate since August 2019. In comparison, the average rate last year was 16.45%.

The best way to handle the increased interest rates on credit cards is to pay off your balance in full each month. If you are unable to pay your balance off each month, consider acquiring extra funds through other methods with lower interest rates, like personal loans.

How do rising interest rates affect my personal loan?

Personal loans are not always affected the same as other consumer products. The impact depends on whether you already have a loan or are looking to get one and whether the loan rate is fixed or variable.

Fixed vs. variable loan interest rates

Most personal loans are fixed-rate loans, meaning your annual percentage rate is not dependent on market factors. Once you obtain a fixed-rate personal loan, your rate will stay the same over the course of the loan.

For those who already have personal loans, this means you don’t have to worry about these rate increases, but for those currently in the market for one, higher rates could impact your decision.

Is now a good time to get a personal loan for doctors?

Though rates are high, they may get higher over the next few months. If you are in need of a personal loan, getting one now could save you from that higher rate if rates increase. If you aren’t sure if you need a loan, we recommend not rushing into the process simply to lock in a low rate.

If you are in need of extra cash without the ability to pay off your need each month, personal loans are a better option than the most common alternative, high-interest credit cards. Credit card rates are also increasing significantly and could result in significantly increased interest expense over time.

How do rising interest rates affect my student loans?

The rising interest rates shouldn’t have a significant effect on federal student loan borrowers at this time, but those with private loans could expect increasing rates.

How will rising rates affect my federal student loans?

The student loan payment moratorium that began in March 2020 has been extended to 2023. All federal student loans have had a set interest rate of 0% and therefore aren’t affected by rising rates at this time. Additionally, federal student loans have been bound by fixed rates since 2006. Only federal borrowers who received a variable-rate student loan before July 2006 would experience a higher rate.

How will rising rates affect my private student loans?

On the other hand, private student loans are not bound by a moratorium thus they will be likely affected by the rising rates, depending on the terms. If you have a variable-rate private student loan, you will experience higher interest rates and the fixed rates you are being offered are likely to increase as well.

One way to manage these rising rates is by refinancing to a lower, fixed-rate loan before rates increase. Check out our guide to finding out if refinancing would be right for you.

How do rising interest rates affect my high-yield savings account?

As interest rates rise on consumer loans and other products, they also increase on high-yield savings accounts, meaning you earn more.

Depending on your bank, you can expect an increase in your annual percentage yield (APY). The higher your APY, the more money you will make passively.

What should I expect with Federal Reserve rate increases?

The Federal Reserve uses rate increases to bring inflation to a more reasonable and sustainable rate. These increases attempt to shrink the supply of money available to make purchases, making money more expensive.

As interest rates rise, consumers typically slow their spending, especially on major purchases, because of the substantial rates that will affect a loan long term.

Though rising rates are a hopeful step toward a less volatile economy, some worry these actions could tip the economy into a recession. An example of this happened in 1980 and 1981. During this time, inflation rose to 14% and the Fed raised rates to 19%. This pushed the country into a severe recession but remedied the extreme inflation rates consumers were battling.

There is no certain way to predict what effect rising rates will have on the economy, but ideally, they will lead to a soft landing where the economy slows enough to temper employment and wage increases without entering a recession.

How Panacea Financial can help you deal with rising interest rates?

Despite the ever changing economy, Panacea Financial is committed to working in the interest of our customers. That is why we offer competitive rates on personal loans, practice loans and student loan refinancing. We also just raised our rates on our high-yield savings accounts to help you grow your money faster as you save.

If you are feeling overwhelmed by the thought of adapting your budget and financial plan to the changing economy, we can connect you with a financial or wealth advisor through our Build Your Team program.

Panacea Financial, a division of Primis. Member FDIC.