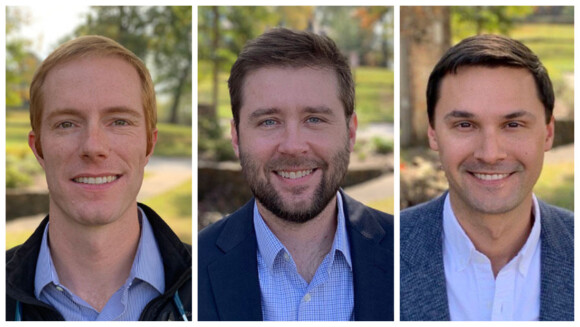

Like many young doctors, Dr. Ned Palmer and Dr. Michael Jerkins dealt with financial struggles early in their careers: Student loans, credit card debt, meager income, and hardly any time to address these problems.

When they looked for help from traditional banks and lenders, Ned and Michael were instead met with high interest rates, co-signer requirements, restrictive loan terms, and flat-out rejections. It didn’t make any sense. As doctors, they were trusted enough to care for patients in the hospital, but not enough to get a personal loan without enlisting their parents as co-signers.

They knew others must be experiencing the same issues. So Michael and Ned started talking to medical students, residents and attendings and heard similar stories: unfair rates, mandatory co-signers, and an unwillingness to deal with customers outside of typical business hours.

Banks didn’t recognize the hard work and dedication it takes for doctors to get through training, nor did they acknowledge their future as high-income earners.

The idea for Panacea Financial was born out of a desire to provide needs-based care for doctors and doctors-in-training. Panacea Financial would grant them access to products and services designed specifically for medical professionals, built by a team that truly understands their needs.

To make it happen, Ned and Michael reached out to Tyler Stafford, who had a deep understanding of the banking industry after spending nearly a decade as a bank equity research analyst. Tyler recognized the struggles of doctors and doctors-in-training and how traditional banks were incorrectly assessing their value as customers. He had seen the undifferentiated product offerings of most traditional banks and wanted to disrupt the industry to better cater to the consumer.

Tyler committed to join Panacea Financial shortly thereafter, leaving his job to take over as CEO. With Tyler onboard, they had all the parts for a team of founders who understood the problem — as well as a vision for how to fix it.

The founders’ last step was to find the perfect banking partner, and Primis Bank was able to provide the foundation for Panacea Financial to build its vision. As a publicly traded bank with several billion dollars in assets, Primis brought a passion for innovation and a shared interest in helping the people often ignored by traditional banks. Together, they saw an opportunity in standing out with top-notch customer service in an undifferentiated bank industry that skimps when it comes to putting the consumer first.

Officially launched November 1, 2020, Panacea Financial tailors products and services to medical students, residents and attendings when they need it most. Doctors and doctors-in-training can expect support from a company that caters to their unique professional experiences. And as new challenges arise, Panacea Financial will be there to grow with medical professionals and show everyone a better way to bank.